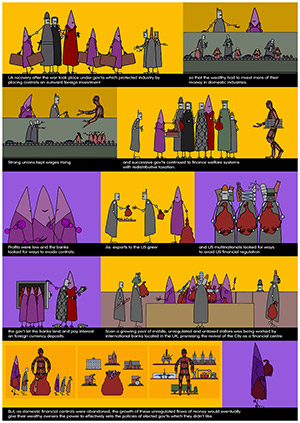

That was Then and This is Now

That was Then and This is Now (2022)

Series of 7 digital prints, dimensions variable

Produced in association with The Crack magazine, Newcastle-upon-Tyne for March 2022 issue.

Notes - That was Then and This is Now

Page 1

In 1945 the UK and its allies had won the war against the Axis powers but the country was nearly

bankrupt. The costs of financing the war had drained the country's reserves and it had huge

outstanding debts. A Labour gov’t committed to full employment was elected with a large majority and

began the reconstruction process, making provision for the most vulnerable and nationalising key

industries funded by high levels of taxation on the wealthiest. It brought the Bank of England under

public control and kept interest rates low so that the gov’t could borrow cheaply. Exchange and capital

controls stimulated domestic investment.

The US, on the other hand, had emerged as the wealthiest nation in the world. During the war the US

had supplied enormous quantities of matériel to the allied combatants. Its economy had grown fivefold

and it accounted for half of global industrial production. However, when the war ended, it was faced

with a problem that could not be easily solved. While the US economy was geared to produce vast

amounts of goods for export, the war-torn countries were almost bankrupt and had little money to

buy what it was making. Either the US could restructure production - reduce exports by closing

factories and laying people off - or it could subsidise the war-torn countries until they had recovered

sufficiently to pay for those exports themselves, giving US industry time to adjust to post-war levels of

demand without an economic collapse.

Before the war the UK had formed an exclusive trading block made up of its colonies and a number of

other countries with whom it had strong trading links. It was known as the Sterling Area. The countries

within this trading bloc tied their currencies to sterling and had relatively open access to one another’s

markets. The UK acted as the bloc’s banker with the member states holding their reserves in London.

This was to the great profit of UK banks which used the sums to finance trade and investment.1

During the war the UK needed dollars to pay for war matériel from the US. The Sterling Area

countries agreed to pool any dollars they earned from exports. These dollars were then redistributed

among the members according to a criteria of need with the UK receiving the largest share.

Consequently all the countries in the Sterling Area acted to reduce their dollar expenditure by

discriminating against US goods.2

With its commitment to full employment, an interventionist industrial strategy and the building of the

welfare state, the continuation of the tightly-knit Sterling Area arrangements in the post-war period

were attractive to the Labour gov’t. They would provide a large, protected market for UK goods and

investment capital and assure the UK of supplies of cheap raw materials and food. Importantly the

arrangement would supply the dollars which the UK desperately needed to buy US food, machine tools

and other goods necessary for survival and reconstruction. That these arrangements were by no means

always in the best interests of the other members was a sacrifice which, one way or another, they

would be compelled to make.3

Under the wartime Lend Lease arrangement the UK had relied on US supplies of almost free food, oil

and matériel. When the arrangement was abruptly terminated in 1945 the newly-elected UK Labour

gov’t was forced to ask the US for a massive loan. In negotiations the US, with its huge trade surplus,

demanded open access to the markets of the Sterling Area countries and an end to the dollar pooling

system which inhibited the Sterling Area countries from converting sterling to dollars in order to buy

US imports. If sterling were to be convertible then the UK would first have to settle its outstanding

debts to the Sterling Area countries.

The UK owed over £3 billion to the Sterling Area countries for goods, raw materials and troops

supplied during the war. US negotiators were aware that if sterling were to become convertible the

holders of the sterling balances would sell their sterling for dollars, draining the UK’s reserves and

bankrupting the country. It appeared essential that the UK settle, block or write off these debts as a

pre-condition of the loan.

Writing off the balances would destroy the UK’s financial credibility abroad and was not considered an

option. Keynes, who negotiated on the UK’s behalf, wanted to block the balances for 5 years to give

the UK time to recover. He also proposed a large cut to the UK’s military budget. But the Bank of

England, representing the financial interest of the City, was only willing to scale down the balances,

fearing that the dissolution of the Sterling Area arrangements and the consequent loss of international

business would destroy any hope of the City recovering its position as a centre of international

finance.4 Eventually a loan of $3.5 billion dollars was granted on condition that sterling became

convertible in one year’s time. The arrangement was a disaster for Britain. In July 1947 restrictions on

convertibility were lifted and the drain on UK reserves was so great that within a month it was forced

to reimpose controls. Convertibility was not restored until 1958 and the Sterling Area arrangements

remained basically intact.

1 Coakley and Harris, The City of Capital, p.34

2 Block, The Origins of International Economic Disorder, p.57

3 Norfield, The City, p.30-33

4 Green, The Political Economy of the Special Relationship, p.94

Page 2

The failure of the US to gain access to Sterling Area markets for its trade surplus and the chronic

situation in Europe still left it exposed to the danger of a slump. In 1946 the European grain harvest

was only 60% of its pre-war level. Food and materials were scarce and rationed, many people were still

displaced and reconstruction was plagued by the damage to transport and communications networks.

Foreign exchanged was controlled and capital movements were largely illegal. Most foreign trade was

conducted through state agencies and bilateral agreements.

The left-wing parties’ commitment to the resistance had enhanced their prestige while right-wing

politicians were tarnished by collaboration with fascism and their association with the economic

disasters of the 1930’s. Throughout the continent there was a strong movement for social reform and a

more equitable distribution of wealth. In this atmosphere employers tended to accede to wage

demands in case more radical measures were provoked. To preserve profits they added rising wage

costs to the prices of their goods. In this way working-class efforts to increase living standards were

continually undermined. Although inflation decreased the value of their assets, firms recognised this

inflationary dynamic as the lesser evil.

Different European countries had varying rates of inflation. Without state controls on the market high-inflation countries would accumulate massive balance of payments deficits as they were deluged with the goods of low-inflation countries. Consequently, while severe inflation pertained, foreign trade would have to be conducted through bilateral agreements or state agencies and, if the demands for higher wages and social reforms continued, inflation would persist. US planners feared that if the kind

of left-wing gov’ts that held power in the UK, France and Italy further extended their controls over

their domestic economies the elimination of private ownership of the means of production might

follow. National capitalism might be the first step towards socialism.

The triangular pattern of international trade that existed before the war had been disrupted. In the

pre-war years Europe had run a trade deficit with the US while the US ran a deficit with the Asian

countries and the circle was completed by the Asian deficit with Europe. However with their reserves

depleted the Europeans were forced to limit their imports from the US. At the same time bilateral

agreements with Asian countries, like those established between the UK and the Sterling Area

countries, meant that the Asian countries also reduced their imports from the US. All over the world

markets for the US surplus were closing. Not only would the US have nowhere to sell its vast surplus

but opportunities for US business to expand overseas in the future might be curtailed. The US vision of

multilateral trade it was so desperate to realise was looking increasingly unlikely.

In the pre-war years significant levels of trade had taken place between eastern and western Europe.

After the war, as the eastern Europeans reorganised their trade along bilateral lines, pressure grew on

the western Europeans to do the same. The Soviet Union had acquired widespread popular respect for

its crucial role in defeating the Nazis and left-leaning western European govt’s were keen to to retain

good relations with their powerful war ally. The more these countries accommodated themselves to

the Soviet Union the less likely they would be to organise their economies along the liberal,

multilateral lines so integral to US ambitions.

Between 1945-7 the US export surplus grew as the war-torn nations bought US goods for

reconstruction with US aid and their remaining reserves but, by mid-1947, that aid was no longer

forthcoming and European reserves were nearing exhaustion. The surplus began to decrease and the

crisis, long-anticipated by US planners, appeared imminent.

The UK’s announcement that it could no longer afford to provide aid to Greece and Turkey raised the

possibility that the Greek left would triumph in the civil war and move towards an alliance with the

Soviet Union. That the Americans might lose their grip on a country of such strategic importance

provoked Truman to ask Congress for special aid to Greece and Turkey. He made a speech in a way

that was designed, “to scare hell out of the country”. Truman’s evocation of the choice between

totalitarianism and freedom produced a crisis atmosphere and Congress promptly approved his

request. This success proved that domestic opponents of internationalism could be neutralised by the

use of anti-Communist rhetoric and the creation of international crises.

Truman’s success with Congress and the critical condition of the US economy resulted in the Marshall

Plan. Even before it passed through Congress, emergency aid to Italy demonstrated how effective the

Plan might be in securing US aims. Italian communists were pushed out of gov’t and the conservatives

were able to impose severe deflationary measures in anticipation of further US assistance. Still, at

home, Truman was obliged to invoke the Red Menace again in early 1948 to persuade Congress to give

its approval to the Plan, this time against the background of of a Communist coup in Czechoslovakia.5

The plan was worth $13 billion to its recipients and earned the US enormous goodwill. Its goals were

the restoration of multilateral trade, price stability and the recovery of production. The Marshall Plan

had to improve Western Europe’s capacity to earn dollars through both an increase in exports and by

an inflow of US investment. It was envisioned that, in 1952, when the Plan ended, the US export surplus

would still exist but it would be based on a higher level of exports and imports and it would be

financed by US private investment in Europe.

Abroad the Plan would allow the US to support the colonial wars of the Europeans in places like

Malaya and Indochina. If the Western Europeans were moving towards multilateralism the US could

identify the international interests of the European states with the prevention of the spread of

communism and the loss of markets.

Within Europe the Plan would finance the efforts of the US intelligence apparatus to split the European

labour movements and bring conservative gov’t to power that were sympathetic to US ambitions.

In countries where the Left was strong reversing inflationary patterns was not easy. US policy found

allies in the banking community and, with their help, drastic deflations were imposed, resulting in the

kind of high unemployment which made it easier for business to resist wage demands.

“The danger of social turmoil was minimised by US efforts to weaken the Left forces. The basic US

tactic was to split the working class movement along communist/anti-communist lines. CIA operatives,

American labor representatives and Cold War rhetoric were used to persuade non-communist trade

unionists to cooperate with policies that were disastrous for the working class.”. 6

With the defeat of the Left, cuts to social spending allowed higher levels of investment in industry. Non-communist trade unions submitted to productivity drives and the US model of labour-management collaboration. However, while deflationary policy contributed to price stability, it often relied on credit restrictions which made it harder for firms to borrow to finance new investment. The

economic slowdown which resulted from the imposition of austerity also made it more difficult for

firms to finance investment from profits. At the same time overall demand was reduced which further

discouraged additional investment. On the other hand if investment were too high it would have an

inflationary effect.

The result was continuous tension between different interests over the balance of investment and

price stability. While the solution of the Plan’s administrators was to promote careful planning with

different countries specialising in particular industries, they were unwilling to coerce private capital to

conform for fear of promoting national capitalist policies.

As it became apparent that the Marshall Plan was not producing the recovery necessary to absorb the

US trade surplus, the US economy began to fall into a recession and, by 1949, unemployment averaged

5.9%. The shadow of the Great Depression hung over US planners and the recession generated great

anxiety.

While it affected all the western European countries the consequences of the US recession were

particularly critical for the UK. The drop in US demand for UK goods and, more significantly, for the

dollar-earning raw materials of the Sterling Area provoked a crisis. The UK’s choice to continue to rely on the Sterling Area’s capacity to earn dollars, its failure to resolve its debts and the weakness of its reserves left it exposed to any downturn in the US.

A devaluation of the pound in an attempt to stimulate UK exports was ineffective. Other European

countries followed the UK ’s lead and devalued their currencies but the net effect was to restrict US

imports to Europe still further.

By 1950 unemployment in the US had reached 7.6% and the US appeared to have exhausted its

attempts to restructure the European economies in a way that would accommodate its enormous

trade surplus. Marshall Plan aid would end in 1952 with little prospect of a successful resolution in

favour of US ambitions and no appetite in Congress to provide yet more aid to the Europeans.7

The radical solution was to be massive US and European rearmament. The victory of the Communists

in China and the Soviet Union’s detonation of an atomic device led to a re-evaluation of US foreign

policy. A National Security Council appraisal imagined a global confrontation between the superpowers

and called for huge increases in defence spending and the re-armament of the western European

countries. Domestically such a policy would provide employment and sustain demand so that the US

would no longer need to maintain an export surplus. Military aid would allow the US to continue

providing funds to Europe when the Marshall Plan expired and the close integration of US and

European military forces would prevent Europe from closing itself off from the US. European

commitment to US strategic objectives would be strengthened by reliance on US military hardware.

However Truman still had to get Congress to agree to this enormously expensive policy turn. Although

McCarthyism was reaching its hysterical height on the back of Truman’s inflated rhetoric, a more sober

Congress required more compelling evidence that massive rearmament was necessary. The outbreak of

the Korean War was enough and spending on national security programmes rose from $13 billion in

1950 to $50 billion in 1953.

The rearmament policy allowed the US to move closer to its aim of restoring a multilateral world

economy. European reconstruction proceeded along lines consistent with US goals and by the end of

the 1950’s the Western Europeans had restored convertibility and were pursuing liberal economic

policies. That the world was deeply polarised and Europe had become a military-occupied zone with a

massive proliferation of nuclear weapons did not sour the triumph of US planners.8

5 Block, The Origins of International Economic Disorder, p76-84

6 Block, The Origins of International Economic Disorder, p.90

7 Block, The Origins of International Economic Disorder, p.93

8 Block, The Origins of International Economic Disorder, p.105-108

Page 3

In the UK during the 1950s successive Conservative gov’ts aligned their outlook with that of the City.

UK policy was oriented towards preserving the Sterling Area and restoring sterling’s convertibility with

other currencies. The Sterling Area was the locus for profitable investment for UK capital and the City

was desperate to maintain sterling's role in the finance of international trade. British goods had

virtually guaranteed overseas markets and the Sterling Area earned dollars which the UK used to

finance its deficit with the US.

But there were severe disadvantages. Despite inward US investment the outflow of UK capital to

sterling area members represented a real drain since that capital was badly needed for reconstruction. The costs of providing military support to defend overseas investments were large and reduced gov’t

spending on domestic projects. Privileged access to Sterling Area markets protected UK industry from

the need to modernise and become more competitive. These factors combined with the historical

tendency of UK investors to look for short-term profits to create a situation where significant

elements of UK industry stagnated in comparison with their European competitors.

In the 1930’s in response to mass unemployment sterling had been priced to give export industries an

advantage and the bank rate set at 2%. Cheap money for industrial investment was given priority over

interest payments to financiers. A government committee on finance and industry called for long-term

loans to industry. The Bank of England set up the Bankers Industrial Development Corporation to

channel investment capital into industrial reconstruction schemes. Shipbuilding, cotton and steel all

benefited. The impressive result of what could be done when the City was directed by government

were clear but it was also clear that this went very much against the grain of the City’s preference for

short-term, arm's-length financing.

During the war government intervention intensified as it directed private capital to key war industries.

A huge range of innovations resulted. Production levels rose. Output in the machine tool industry grew

fivefold between 1935 and 1942. The steel industry was modernised and an increase in the production

of chemical fertiliser increased agricultural output. The intervention of government and its direction of

industrial investment in the 1930s and 40s stimulated immense scientific and productive progress.

After the war a Labour government, despite being under great financial strain, continued in the same

vein. Controls kept interest rates low and nationalisation and economic planning overrode the

interests of the City. Resources continued to be diverted towards the scientific establishment.

By 1950 the UK had undergone a kind of limited, military-industrial revolution. It was strong in

aerospace, weapons, chemicals, communications, pharmaceuticals and a range of high-technologies. But the post-war Labour government had failed to create financial institutions which might channel long- term investment to industry as the banks had been forced to do during the war. Instead, under consecutive Conservative governments, the Bank of England and the Treasury worked to re-establish

the City’s former overseas role. A Bank of England paper of 1957 noted that if the government wanted

to maintain full employment it would need to extend existing controls over the banks to supplement

interest rate policy but it cautioned that this would limit the scope of the City’s foreign operations.

City profits were to be prioritised over production and employment.

In 1958, with the UK’s creditors temporarily reassured, sterling became convertible again.“The clearing

banks could once more absent themselves from British industrial investment. Shareholders could

return to their historic mission of searching for the highest returns. The great merchant banks could

again look for the best returns from the international arena and even if capital controls restrained their

appetite, the Euro-dollar market was soon to provide juicy pickings. British companies, with their

shifting shareholder base and weak support from their banks, would be forced to finance their

operations from retained profits – and displace risk on to their workforces. The government would

remain only weakly committed to scientific and technological support, focusing on defence and military

requirements. The financial juggernaut with its roots deep in British economic, political and social

history could again resume its destructive advance.”9

As Hutton points out, this destructive advance gathered momentum with the development of the

Eurodollar market in London. As the Western European economies recovered during the 1950’s their

imports to the US rose and, by 1958, the US was running a trade deficit with Europe. Dollars began to

accumulate in Europe. In the past these dollars would have been deposited in accounts in the US but

more stringent banking regulations, created in the 1930’s to reduce the risks of another Wall Street

crash, made it possible for UK banks to offer higher interest rates than those available in the US. These

deposits were known as Eurodollars and, at a time when the movement of capital between states was

generally subject to restrictions, they represented what would become a global system of offshore,

unregulated, untaxed capital flows.

9 Hutton, The State We’re In,p.126-131

Page 4

When a Labour gov’t was elected in 1964 it inherited a record trade deficit. Its decision not to devalue

the pound immediately led it to take a series of loans from the US-controlled International Monetary

Fund until eventually, in 1967, devaluation proved inevitable. The boom, stimulated by the preceding

Conservative government, had re-awoken the stock market and asset-strippers were able to raise

money to purchase the stagnating firms which had proliferated in the climate of under-investment and

uncompetitive colonial preference. Those companies engaged in this activity were able to show profits

by selling off the property and land of these less profitable industries to developers. They were

heralded widely as industrial savants who could generate profits and increase productivity with little or

no investment. That this activity was essentially fraudulent only became apparent later by which time

much had been lost and many sites of manufacturing had disappeared forever.10

The 1967 devaluation signalled the end of the Sterling Area and the pound’s rôle as an international

transactions currency. The sterling balances, which Britain's creditors had been at times forced and at

others cajoled, persuaded or blackmailed into holding in London, depreciated and confidence in the

U.K.'s ability to honour its debts was seriously weakened. But the City had long seen this event coming.

Throughout the 1960’s it had developed its enclave, offshore Euromarket function until billions of

dollars were circulating through the foreign arms of the U.K.'s financial sector making it the world’s

leading centre for the international borrowing and lending of dollars.

The loans, taken by the Labour government from the IMF as it tried to prevent devaluation, had

brought the UK firmly within the disciplinary orbit of US power. Against the Labour government’s

policy of industrial investment the IMF demanded action on wage restraint, prices and gov’t spending as

a condition of its loan.

The Heath government that came to power in 1970 went further. Instead of an interventionist

industrial strategy it proposed the fight against inflation and the disciplinary affect of market forces.

Restrictive trade union legislation was passed, firms in financial difficulties were not supported and the

most profitable sections of nationalised industries were sold off. The impact of these policies was an

unqualified disaster. Anti-union measures galvanised working-class solidarity, competitiveness was not

restored and the economy floundered. But the most catastrophic policy was the introduction of

Competition and Credit Control (CCC).

Attempts to limit the flow of credit during the 1960’s had resulted in restrictions being placed on the

UK domestic clearing banks but, as London became the global centre of international finance,

the domestic banks pushed successfully for the removal of restrictions so they could compete with

their better-capitalised, international rivals. The relaxation of the Bank of England’s control of the ratio

of the clearing banks’ deposits to lending created a credit boom as the banks massively expanded their

reserve assets. While nominally intended to stimulate investment most of the money was channelled

into a speculative stock market and property boom, fuelling inflation and yet further aggravating the

balance of payments deficit by stimulating imports.11

Supported by the Heath government’s anti-union legislation, and keen to pass the cost of rising prices on to

the working-class, employers refused wage demands. A wave of militant action followed and when Heath

eventually raised interest rates, in an attempt to control inflation, the speculative bubble burst. A major

financial collapse followed and the gov’t was forced to bail out the City to the tune of £3 billion.12

The crisis deepened when the cost of oil rose steeply.The gov’t refused a claim by the miners for a wage

increase that would match rising prices and power stations ran out of coal as incensed workers prevented

deliveries.

10 Adam Curtis, The Mayfair Set, Episode 2 - Entrepreneur spelt S.P.I.V, BBC player, https://www.bbc.co.uk/iplayer/episode/p073kdmq/the-mayfair-set-2-entrepreneur-spelt-spiv

11 Green, The Political Economy of the Special Relationship, p.158-161

12 Coakley and Harris, The City of Capital, p.72

Page 5

After the 1967 devaluation, coordinated international action had been taken to rebuild the U.K.'s reserves

and stabilise sterling by encouraging countries to hold on to sterling balances so that they could be

unwound in a controlled manner. But following the oil price hike many OPEC countries chose to buy

sterling, meaning that the sterling balances were even larger rather than being wound down as had been

planned. By 1976 they were twice the size they had been in 1968. This made sterling particularly vulnerable

to speculative movements in the currency markets. This vulnerability was increased by the vast, unregulated, offshore funds now existing in the Eurodollar market whose holders had the ability to conduct moment-by-moment referendums on UK policy, expressing their disapproval by withdrawing funds and bringing down the value of sterling.13

The situation inherited by the Labour gov’t in 1974 was precarious. Coming to power in the aftermath of

the banking crisis and the stock market crash it faced rapidly rising inflation, a liquidity crisis in industry and

a deteriorating balance of payments deficit. Labour’s election manifesto promised to deliver the most radical

reorganisation of UK industrial policy since 1945. The Alternative Economic Strategy (AES) proposed by the

party’s left-wing and supported by the unions promised a programme of nationalisation, compulsory

planning agreements allowing gov’t direction of private capital and a major programme of wealth and

income redistribution. Social service provision would increase and workers involvement in industrial

decision-making would be supported.

The loss of profits and the challenge to their autonomy which the strategy implied did not only create alarm

amongst industrial interests. To foster and protect emerging UK industries the AES called for a selective

insulation from the world economy with the implementation of exchange controls and import restrictions

but these presented a grave threat to the international openness on which the City’s Euromarket activity

depended. When the Labour Party Conference endorsed a proposal for the party’s executive committee to draw up plans to nationalise the domestic clearing banks, the media and the UK financial and industrial

establishments were united in opposition.14

In 1976 the continuing balance of payments crisis forced the gov’t to ask the IMF for a loan. On the left it

was felt that the UK’s negotiators had considerable leverage. The UK’s place in the international financial

order was significant and if the Labour gov’t fell control over the unions might be lost altogether. US 15

Treasury officials certainly feared that the UK might default on its loans and this might lead to the collapse

of gov’ts in France and Italy. Ultimately though, the UK was forced to accept the IMF’s terms after banks in

both the US and the UK refused to buy the gov’ts bonds. The conditions of the loan forced deep cuts to

public spending and the welfare bill in particular. The AES was finished and a period of austerity loomed.

The nature of the IMF’s operation was political. “It was designed to erase what remained of the socialist

aspirations in Labour’s 1973 program and 1974 manifestoes... and to reassure the City that the nostrums

and priorities of the financial sector, not elected politicians, were now setting the economic agenda.” In 16

1978, committed by the IMF to huge cuts to public expenditure, and with inflation at 10%, the gov’t tried to

limit pay increases to 5%. A wave of strike action followed which became known in the UK’s right-wing

press as the Winter of Discontent. Derek Jameson, editor of the Daily Express in 1979, said of his

newspaper’s coverage of the disputes , “We pulled every dirty trick in the book. We made it look like it was

general, universal and eternal, whereas it was in reality scattered, here and there, and no great problem.” 17

It was effective though and, in 1979, a Conservative gov’t was elected on a promise to control inflation,

reduce unemployment and sell off the UK’s council housing stock to its tenants at a discount.

The response of the US, the IMF and the banks to Labour’s radical policies laid the ground for the new

Conservative government’s break with the post-war consensus. With the interventionist approach defeated,

financial liberalisation could develop largely unopposed. With the removal of all restrictions and controls on

capital’s trans-national mobility the multilateral world imagined by US policymakers in the 1940s was finally

able to emerge.The commitment to full employment and social equality was abandoned for anti-inflationary

policies which would secure the value of assets.

Falling incomes would make people dependent on consumer borrowing and house price inflation. “An Anglo

American heartland of debt-driven consumption and financialisation would underpin the neoliberal world

model that exploded spectacularly in the 2000s.”18

Beneath the rhetoric of pseudo-scientific laws about the causal relationship between the money supply and

inflation, and the austerity it proposed, lay the restoration of class power. Expectations of full-employment,

rising wages and improving living standards were eradicated by monetary tightening and the decimation of

the trade unions. The outward focus on monetary targets masked the strategy to drag down wages by

inducing recession, slackening demand, provoking unemployment and producing spare capacity. Existing

controls on foreign exchange markets were removed immediately. Pension funds increased their foreign

holdings substantially and UK banks quintupled their overseas earnings over the next four years. Profits

were so great that the gov’t was able to impose windfall taxes. Removal of the restrictions on lending

permitted the banks to move into the mortgage market.

The 1980 Housing Act allowed council tenants to buy their homes at discounted prices. Between 1980 and

1982 bank lending to the mortgage markets rose from £50 million per month to over £3.5 billion per

month. Noting that the building societies market share dropped over the same period, Green detects the

beginning of the intensified mortgage market competition that would lead to the sub-prime crisis of 2008.19

13 Green, The Political Economy of the Special Relationship, p.169

14 Medhurst, That Option No Longer Exists, p.100-109

15 Green, The Political Economy of the Special Relationship, p.181-2

16 Medhurst, That Option No Longer Exists, p.133

17 Medhurst,The Myth of the 1970s, Red Pepper, https://www.redpepper.org.uk/the-myth-of-the-1970s

18 Green, The Political Economy of the Special Relationship, p.194

19 Green, The Political Economy of the Special Relationship, p.222

Page 6

With the pound rising on the back of increasing North Sea oil revenues UK exports were priced out of

international markets. High interest rates increased borrowing costs and output from manufacturing

industry fell by 20% in one year. Unemployment soared. In 1984 the gov’t engineered a dispute with the

NUM which led to a bitter, year-long strike. It was a conflict for which the gov’t had begun preparing 7 years

earlier. In the end, with their demands unmet, the miners returned to work, unable to resist the brutal

implementation of the gov’t’s legislation. Increasingly confident, the gov’t accelerated the discounted sale of

nationalised industries, a policy which had received scant mention in the manifesto. Quick profits were

made as new owners stripped assets, laid off employees and renegotiated contracts.

As the City opened up to international competition the traditional, informal supervision conducted by the

Bank of England and members of the banking elite was replaced by formal self-regulation characterised by a

“light touch” approach and minimal bureaucracy.20 The gov’t’s vision was for the UK financial markets to be

as competitive as possible.

US banks had already become established in the City in the 1960s to take advantage of the Eurodollar

market. A second wave now followed buying up smaller UK financial institutions that were unable to

compete with their better-capitalised US rivals. In 1986 legislation was passed which allowed US investment

banks to establish mortgage-lending subsidiaries in the UK and UK retail banks to originate mortgages. 21

The American banks introduced securitisation to the UK and the increased liquidity created an enormous

expansion in the scale and scope of mortgage lending.22

In the UK internationally open financial institutions were able to draw global investors into the purchase of

residential mortgage backed securities (RMBS), expanding mortgage lending still further and increasing the

profitability of securitisation. As the boom continued the UK mortgage market came to rely on the

continued liquidity of the RMBS market and an “abundance of low-priced capital obtained through global

capital markets”.23 As the UK mortgage market grew the risk multiplied that an economic downturn would

create a situation where mortgages could not be paid and made it more likely that such a crisis would

spread internationally. But the booming mortgage market could only exist because so many low-paid

workers were prepared to run up huge debt burdens and by 2004 £1trillion was owed by UK households.24

20 Green, The Political Economy of the Special Relationship, p.235

21 Green, The Political Economy of the Special Relationship, p.237

22 Securitisation is a process of packaging debts and selling them on. Mortgage debts, credit card and consumer loans are categorised according to risk, bundled and sold off to investors.The originator of the loans doesn’t receive their full value (due in years

to come), but a lesser amount, the return of liquidity compensating for the discount. Securities like these are known as collateralised

debt obligations(CDO).

23 Green, The Political Economy of the Special Relationship, p.238-9

24 Green, The Political Economy of the Special Relationship, p.239

Page 7

In 1997 a New Labour government was elected. Having dropped its historic commitment to nationalised

industry and public ownership it fully endorsed the central neoliberal tenet that economic policy should be

determined by all-powerful, all-knowing markets. Obtaining the City's “credibility” would override any

commitment to social justice or redistributive policy. Instead of trying to prevent the precipitous decline in

manufacturing with an interventionist industrial policy it looked to the growing contribution of financial

services to reinvigorate the economy. While the City was now the largest source of international bank

lending, the lax regulatory environment and the existence of a revolving door for top bank staff and

regulatory agency personnel reduced the quality of oversight and amplified the risk of systemic collapse. As

this Anglo-American financial architecture was adopted internationally, systemically significant banks built up

huge leverage ratios backed by inadequate capital.

In 2006, with UK mortgage lending at 65% of GDP, inflation, interest rates and oil prices began to rise. In

the US sub-prime borrowers were unable to repay their mortgages. House prices began to fall and defaults

escalated. The bubble burst and banks and financial institutions found themselves holding vast debts that

could never be recovered. In 2007 the UK gov’t was forced to guarantee the deposits of mortgage-lender

Northern Rock. When Lehman Brothers collapsed the following month the US Federal Reserve lent a

staggering $585 billion to foreign central banks. As the crisis spread around the world, gov’ts adopted a

policy of buying back gov’t bonds from the private sector on an extraordinary scale. By 2019 the central

banks of the UK, the US, the EU and Japan had injected over $10 trillion of digitally-created money into the

global financial system in this way, preserving the financial system intact without any significant reforms.

While the banks had been bailed out, the public were left with the bill.

In 2010 a coalition gov’t of Conservatives and Liberals initiated a policy of austerity. Panic over the deficit

was used to justify cuts to public spending on an unprecedented scale.25 The emphasis was on shrinking

state spending and reducing gov’t debt to boost consumer and business confidence. While taxes were kept

low for the wealthiest, the loss of essential services forced the poorest to pay for the recklessness and

greed of the financial sector. These were the very people who had gained nothing from the boom years and,

in 2012, riots broke out across the country. Re-elected in 2015, a Conservative gov’t announced yet further

cuts bringing projected public spending down to levels not seen since the immediate post-war period.

Zero-hours contracts proliferated and part-time work increased. Developments in surveillance and tracking

technologies created a new level of invasive supervision. Many poorly-paid people were now working harder

for less money. As house prices continued to rise young people found themselves paying inflated rents with

little hope of ever owning a home.

With the value of out-of-work benefits declining and in-work poverty increasing, food banks, almost

unheard of before 2000, became common. Household debt exceeded its pre-crisis level in 2015 and

continued to rise swiftly.26 For that large section of the population who had been unable to take advantage

of the housing bubble life had become more and more precarious.

At the same time the financial sector benefitted greatly from the City’s money-laundering activities. A

Chatham House report in 2021 begins by noting that the UK has long been, ”a comfortable home for dirty money”, pointing to the weakness and under-funding of regulatory bodies.27 Despite this lack of supervision,

in sharp contrast to that imposed on the lowest-paid, the Financial Conduct Authority was still able to

mount prosecutions which yielded over £500 million in fines in 2021.28 That the fines alone should

constitute this sum indicates the scale of the City’s illegal activity.

During the Covid-19 pandemic the country relied on the work of the lowest paid to keep shops open and

provide deliveries and essential services. More exposed, they were three times more likely to die of the

disease than those with in higher-paid occupations. They were also more likely to have suffered job losses.29

Yet, as restrictions lifted and inflation rose to 5%, the governor of the Bank of England advised employees to

show restraint in their requests to employers for wage increases that would keep pace with rising prices.

This contempt for the people who made the greatest sacrifices through the pandemic was echoed by the

country’s leading energy supplier. Addressing the prospect of huge hikes to energy bills, SSE, the recipient of

profits of £600 million in 2020, advised its customers to do star jumps if they couldn’t afford to turn on

their heating.30

25 Green, The Political Economy of the Special Relationship, p.258

26 TUC, Record household debt levels show why workers need a new deal, https://www.tuc.org.uk/blogs/record-household-debt-levels-show-why-workers-need-new-deal

27 Heathershaw, Mayne et al,The Uk’s Kleptocracy Problem, https://www.chathamhouse.org/sites/default/files/2022-01/2022-01-17-uk-kleptocracy-problem-heathershaw-mayne-et-al.pdf

28 Financial Services Authority, 2021 Fines, https://www.fca.org.uk/news/news-stories/2021-fines

29 Resolution Foundation, Low Pay 2021,https://www.resolutionfoundation.org/app/uploads/2021/06/Low-Pay-Britain-2021.pdf

30 The Guardian 10/1/22, Jedidajah Otte, ‘Do star jumps’: energy supplier criticised over advice on keeping warm, https://www.theguardian.com/money/2022/jan/10/do-star-jumps-uk-energy-supplier-sse-criticised-over-keep-warm-advice

Bibliography

Block (1977) The Origins of International Economic Disorder, Berkeley: University of California Press

Green (2020) The Political Economy of the Special Relationship, Princeton: Princeton University Press

Coakley and Harris (1983) The City of Capital, Oxford: Basil Blackwell Ltd

Medhurst (2014) That Option No Longer Exists, Alresford,Hants: Zero Books

Blakely (2019) Stolen, London: Repeater Books

Hutton (1995)The State We’re In, London: Vintage

Curtis (2003) Web of Deceit, London: Vintage

Darwin (1991) The End of the British Empire, Oxford: Basil Blackwell Ltd

Edgerton (2006) Warfare State, Cambridge: Cambridge University Press

Norfield (2016) The City, London: Verso

Bullough (2019) Moneyland, London: Profile Books Ltd

Brown (1997) Sabotage, Nottingham: Spokesman Books

Cummings (2010) The Korean War, New York: Modern Library

Eichengreen (2011) Exorbitant Privilege, Oxford: Oxford University Press

Streeck (2017) How Will Capitalism End?, London: Verso

Slobodian (2018) Globalists, Harvard: Harvard University Press